GEP I

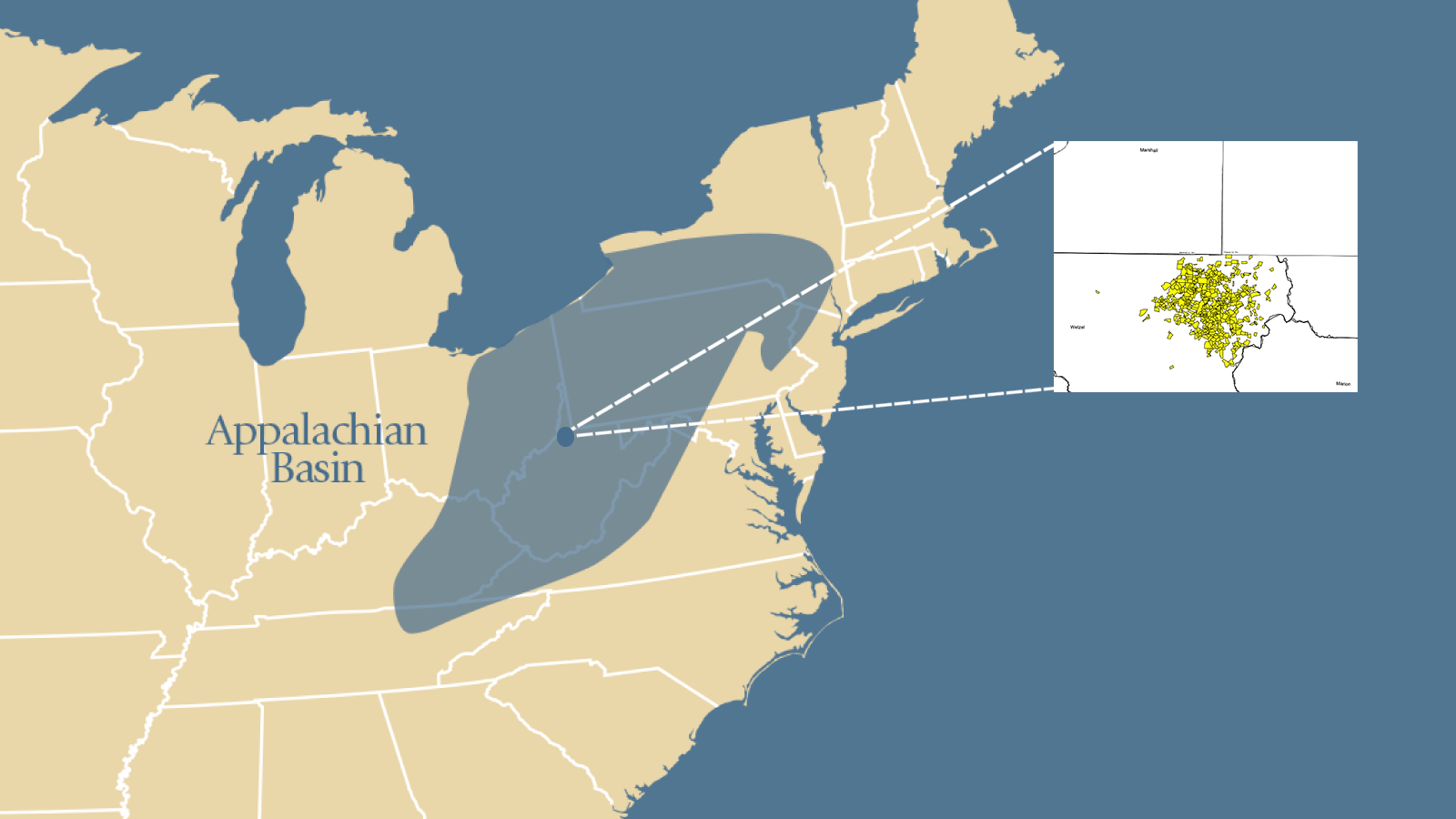

Grenadier I established itself in Wetzel County, WV through a joint venture with Drilling Appalachian Corp., a local WV shallow gas operator. Through the partnership, the company was able to grow the asset base to ~20,000 net acres. When the assets were sold to Statoil USA in December 2012, GEP had drilled 9 horizontal Marcellus wells and, through its subsidiary Grenadier Energy Gathering, had built ~25 miles of gathering lines and a compressor station to connect to what is now Williams’ interstate gathering system. At the time of the sale, two of GEP’s wells were in the top ten in WV on a Bcf/CLAT basis.

GEP II

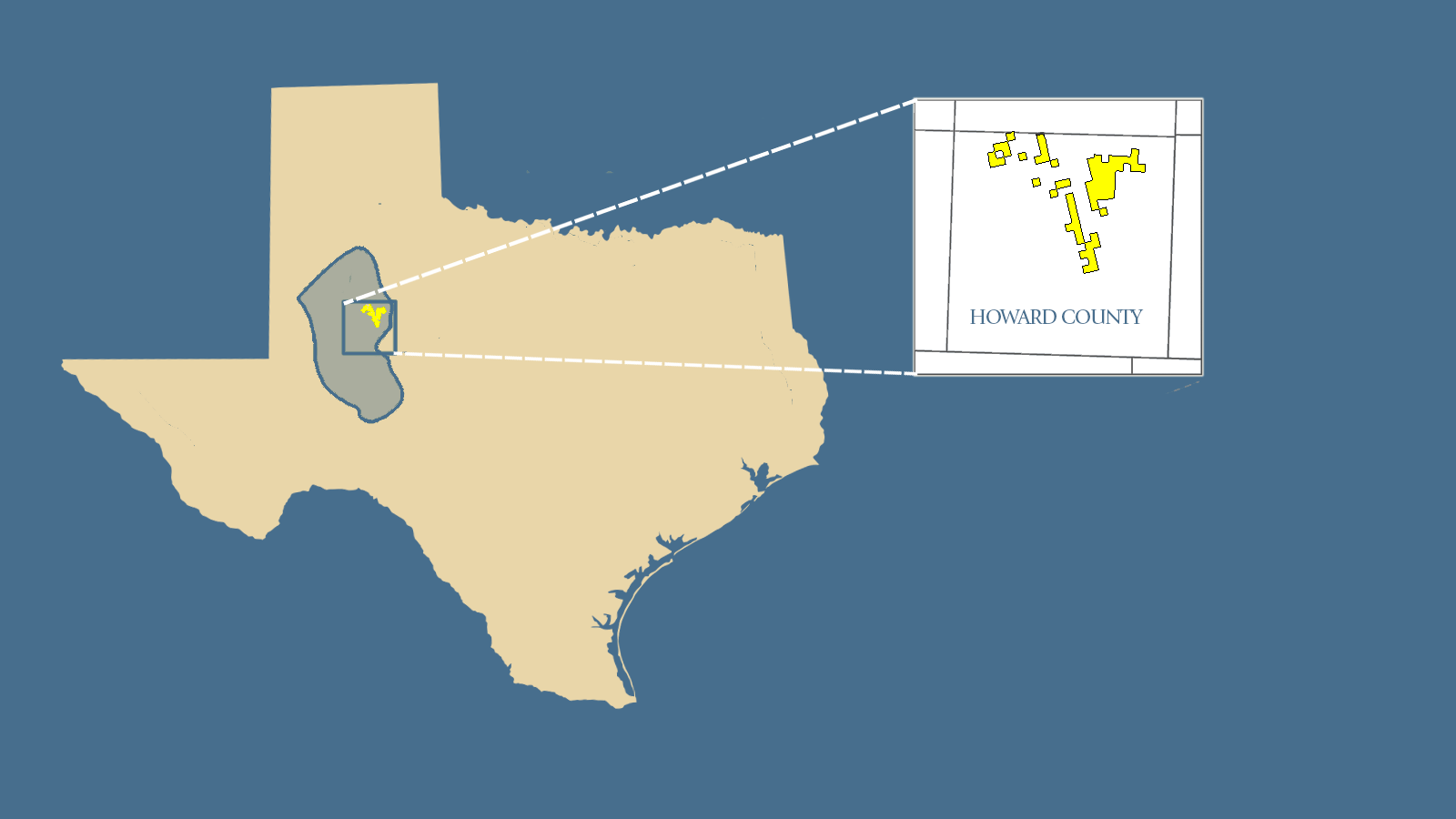

Grenadier II entered the Permian basin in 2016 through a farmout with a large independent operator in Howard County. The farmout initially consisted of ~7,500 acres and two producing horizontal wells. Through an aggressive lease and acquire strategy, GEP was able to grow the position to over 20,000 acres. Over a four-year period, GEP drilled 37 horizontal wells in the Wolfcamp A, Lower Spraberry, and Wolfcamp B formations and grew production to reach a rate of 12,000 boepd. During that time, the company worked aggressively to lower lifting costs and D&C spend to be competitive with the best offset operators in Howard County.

GEP III

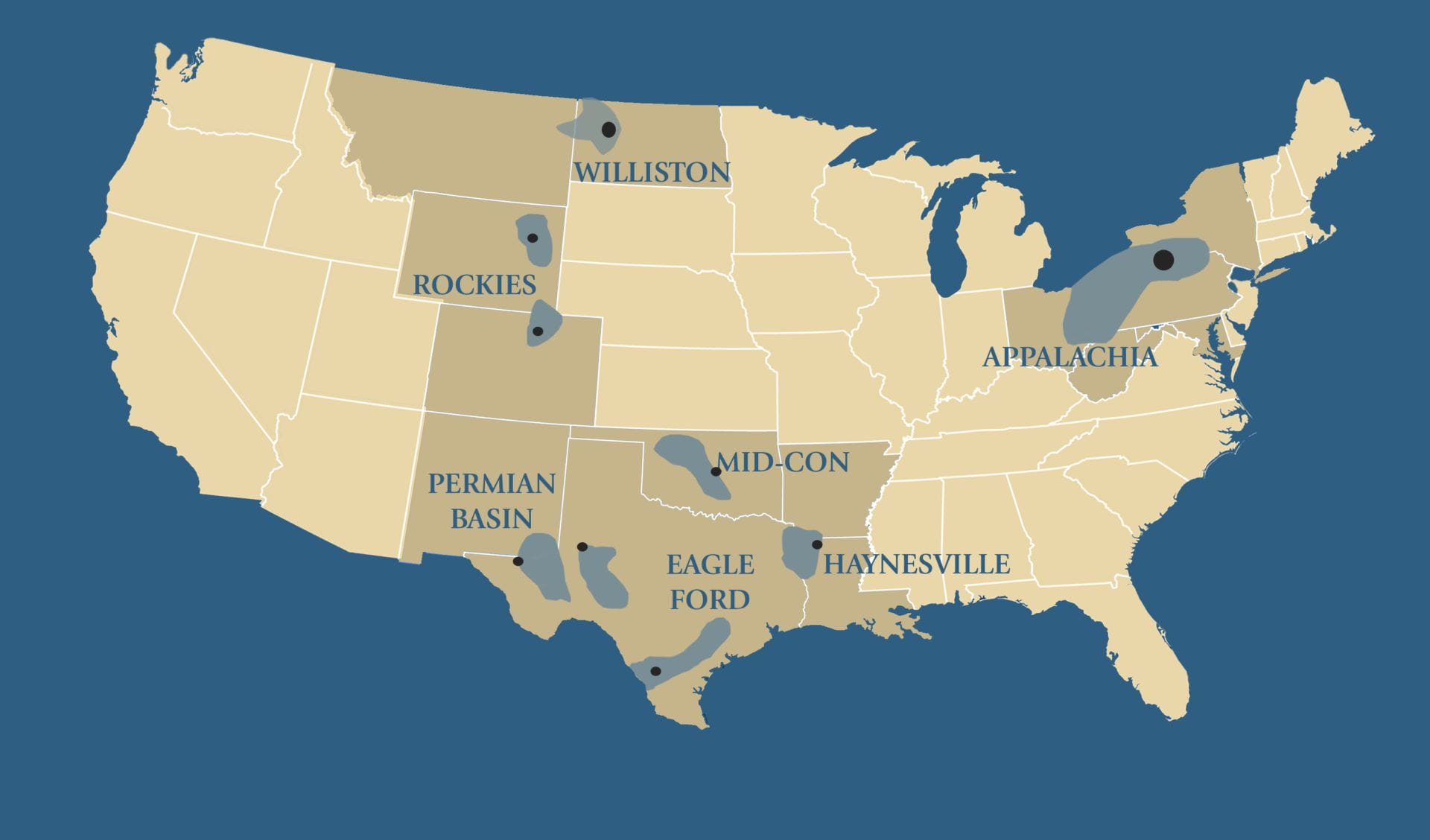

Grenadier III’s focus is on the premier onshore unconventional plays in the US. The management team’s goal is to build a company of scale that can generate significant free cash flow and return value to our shareholders. The team is evaluating deals in all of the major unconventional basins with a primary focus on the Permian Basin.